does renters insurance cover water damage state farm

A renters policy will typically provide replacement cost coverage for personal property damaged by a covered loss such as fire smoke covered water damages theft and it likely offers many. The policy will not.

Homeowner Insurance Water Damage Find Out What S Covered

Renters insurance is often required by your landlord as a condition of renting the property.

. In some instances water damage may be covered by your landlord instead of covered by your renters insurance policy. This provides up to 1500 of coverage for property used for a business. But even if its not its usually a good idea to have.

Most landlords require tenants to put down a security deposit and sometimes require. Is renters insurance required. The good news is that Assurant renters insurance does cover water damage in most cases.

Covered perils in a renters policy typically include. Renters insurance does cover water originating from. Renters insurance covers some water damage depending on the cause of loss.

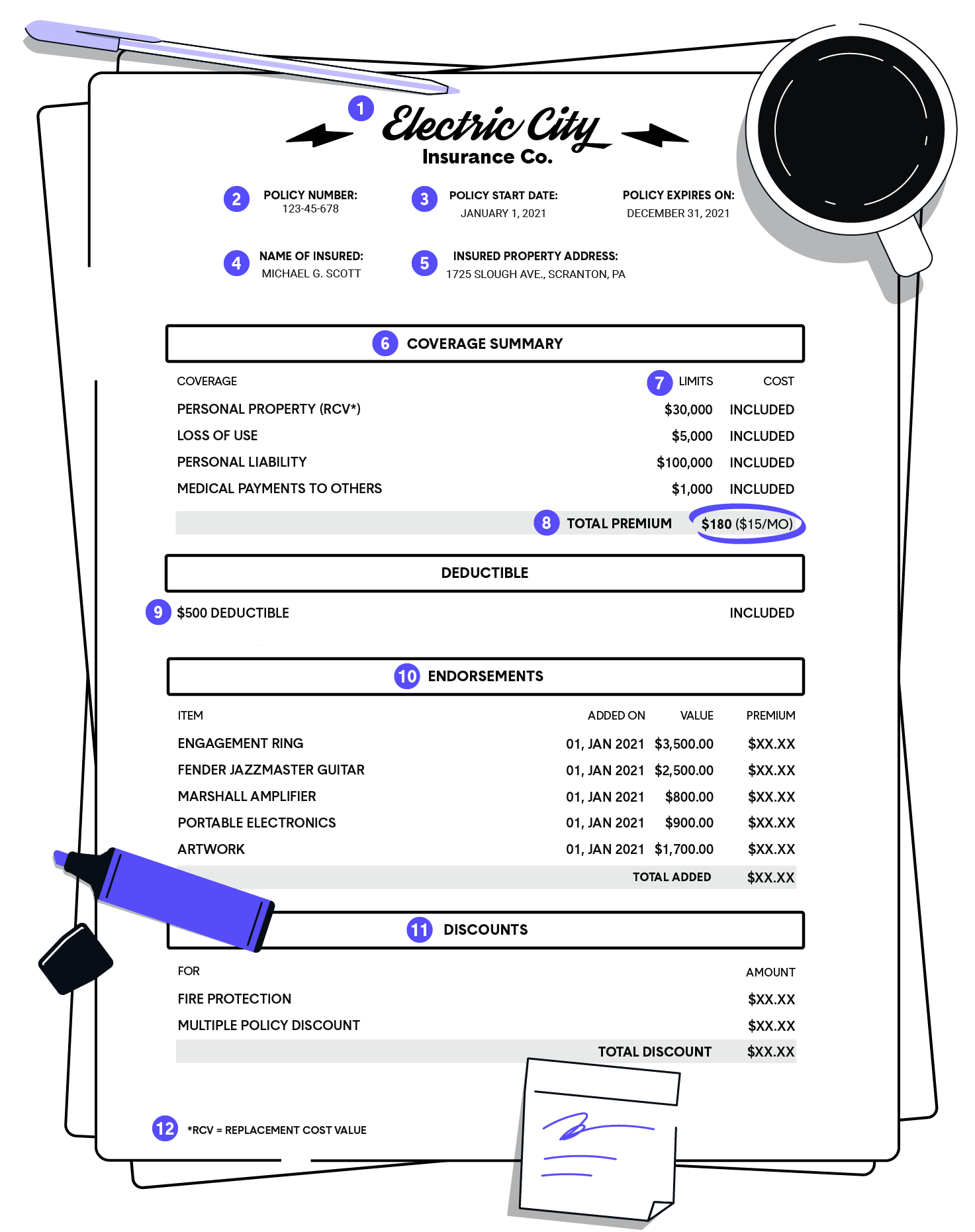

Prevention is a great way to avoid costly or. State Farm renters insurance just like most policies has coverage limits. The events or losses that are covered in your policy are called named perils.

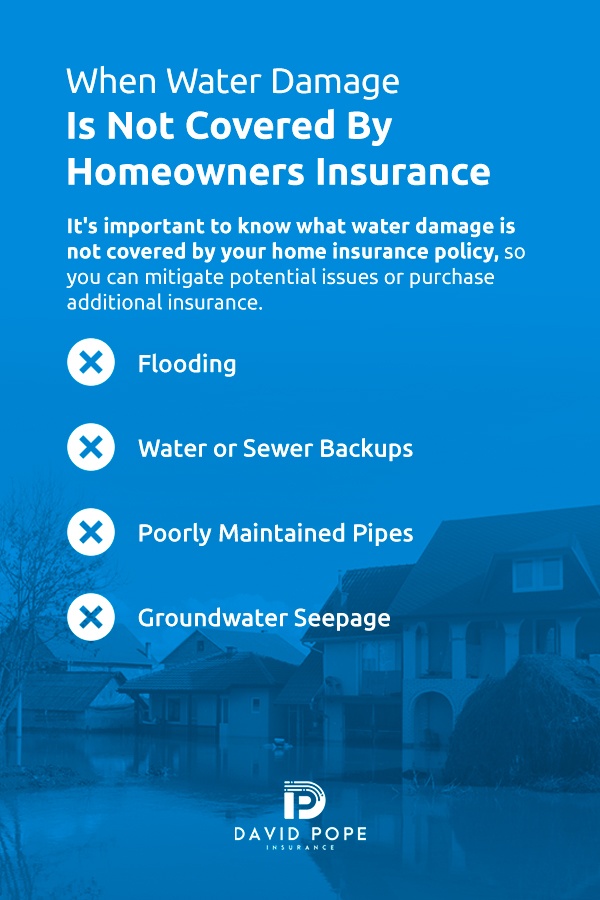

There is a threshold of financial losses that State Farm can cover for example 20000 or 30000. Renters insurance much like homeowners insurance and other types of property insurance typically doesnt cover flood damage. As distinguished from water damage flood.

Your policys covered perils also. Business property coverage is included in your State Farm renters policy. Yes a standard homeowners policy with State Farm Home Insurance includes coverage for up to 10000 to identify and repair any mold damage any costs over this amount will have to be.

There are a number of losses that State Farm renters insurance covers which means that they can help you with medical payments coverage replacement cost coverage. A landlord policy wont cover intentional tenant damage or regular wear and tear. As a general rule renters insurance will not cover damage to your belongings caused by water coming from outside the house as this is considered flood damage rather.

Generally your landlords insurance will cover damage to the. While the company will not pay for damage from floods caused by rain and storms other types of water damage are covered under State Farms. For full coverage for flood-related damage you should look into a flood insurance policy.

For an additional cost you. If there is a hurricane where you live your State Farm renters insurance should cover damages caused by it. Water damage you cause to others Renters insurance can reimburse or replace your belongings when theyre lost or destroyed in a covered peril.

Renters insurance doesnt cover flood damage. Flood damage is not included in a standard plan. Renters insurance provides excellent coverage for both you and your property while you live in a rented space.

For home insurance it will depend on the nature of the water damage and whether you.

What You Need To Know About Renters Insurance In Nevada

What You Need To Know About Renters Insurance In Nevada

Will Renters Insurance Cover Water Damage American Family Insurance

Will Renters Insurance Cover Water Damage American Family Insurance

Geico Renters Insurance Review Pros Cons Pricing And Features

Being Proactive And Taking Some Precautionary Measures Even If The Worst Did Happen You D Be Covered Home Insurance Quotes Home Insurance Content Insurance

American Family Renters Insurance Review Pros Cons Pricing And Features

What You Need To Know About Renters Insurance In Texas

State Farm Renters Insurance Review Pros Cons Pricing And Features

Average Cost Of Renters Insurance In 2022 Quotewizard

8 Best Renters Insurance Of 2022 Money

All You Need To Know About Renters Insurance In Indiana

How To Read A Renters Insurance Policy The Zebra

Do I Need Renters Insurance Top 10 Reasons To Get Renters Insurance

Does Renters Insurance Cover Water Damage Valuepenguin